by Chris Hargreaves | Dec 10, 2023 | Carbon Sustainability, Energy, Energy Attribute Certificates (EAC's), News

Contributed by Paul Coster, Founder of EVA Marketplace

Given the need for businesses to slash fossil fuel consumption, part 1 asked the burning question, ‘can backing renewables be both a pragmatic commercial decision and contribute to climate action?’ I then explained that the climate-friendly way for most New Zealand businesses to back renewable energy is through electricity, by both demand response and supporting additional renewable generation.

Here in part 2, I will start by detailing the solutions available to businesses, explain the role played by energy certificates, and then discuss which solutions can have the most impact.

Solutions

Readily available solutions for supporting renewable electricity are shown below. Each of these solutions requires an electricity supply agreement, and some require a power purchase agreement (PPA). See this recent blog post by EVA to learn more about PPAs and how they differ from supply agreements.

Businesses can combine solutions for greater impact, such as having demand response, on-site generation, and a corporate PPA. In all cases, a relationship with an electricity retailer is retained.

1. Demand response

Technology is installed on the business’s site that allows electrical equipment (including battery storage) to respond to changes in the electricity market, such as high prices or plentiful renewable generation.

Use case: industrial facility installing technology to switch between an electric boiler and a thermal (e.g. biomass) boiler to produce steam. The thermal boiler is used during high prices or when the carbon intensity of the grid is high. An example is

Open Country using Simply Energy’s technology.

2. On-site generation

Renewable generation is installed on or near the business’s site. The project is owned by the business, or owned by a developer who agrees to sell the electricity onto the business via an on-site PPA.

3. Corporate PPA

Renewable generation is constructed remotely (‘off-site’). The project is owned by a developer who agrees to sell the electricity to the business via a corporate PPA, helping to financially support their project. The corporate PPA will typically be sleeved (bundled) into the business’s supply agreement.

4. Indirect utility PPA

Renewable generation is constructed off-site. The project is owned by a developer who agrees to sell the electricity onto a retailer via a utility PPA, helping to financially support their project. The retailer on-sells the electricity to the business under similar terms using PPA sleeving (bundling).

5. Project-linked supply

Renewable generation is constructed off-site. The generator agrees to sell the project’s renewable attributes onto a retailer via energy certificates. The retailer passes the certificates onto the business under their electricity supply agreement or another agreement.

Use case: a business that receives energy certificates from a new renewables project under their electricity supply agreement.

Energy certificates

Energy certificates play an essential role for these solutions where renewable electricity is exported into a network. The certificates track renewable attributes for each unit of electricity, avoiding double counting (*1) and reducing the chance of mis-leading claims (*2).

Currently, energy certificates don’t consider the impact of a solution, such as its economic, environmental or social benefits. In New Zealand, issuers of energy certificates are Brave Trace. (NZ-ECs) and Energy Market Services (iRECs). Certified Energy recently announced future plans to add an impact attribute to their certificates.

Impact

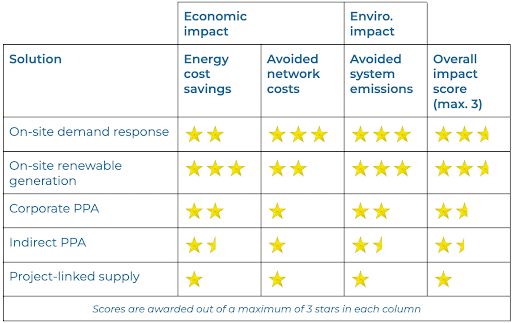

In assessing the potential impact of each solution, we’re going to focus on their economic and environmental impact. The social impact of each solution will greatly depend on the approach taken by the project developer (e.g. community involvement and initiatives).

In order to assess potential impact, I considered various factors, including these three key solution characteristics by asking the following questions:

- Additionality: To what extent would the avoided system emissions have occurred in absence of the solution?

- Location: How does the physical location of the solution (on-site or off-site) affect energy cost savings and avoided costs or emissions?

- Timing: How does the timing of the demand response or electricity generation affect energy cost savings and avoided costs or emissions?

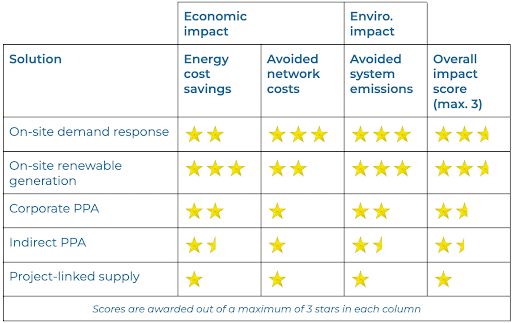

A broad brush assessment of each solution’s potential impact, based on NZ’s current market and the evidence I’ve seen, is shown below. In the complex real-world, the impact will vary for each individual solution (or combination of solutions) and, in the case of demand response, how it is operated day-to-day. Discussion of real-world impact is rich and requires its own series of blog posts.

Generally, demand response and on-site generation, particularly when combined, have the highest potential for commercial and climate impact. They’re followed by PPAs, an excellent solution for businesses where on-site solutions aren’t feasible or can’t meet their full electricity needs. Solutions that solely rely on energy certificates, like a project-linked supply, will typically have the lowest impact. Their impact depends on the revenue created by the certificates and how this money is used (businesses should request transparency).

Like part 1, this post is my current thinking, which I hope opens up more discussion about the impact businesses can have on Aotearoa’s clean energy transition.

* References

1. “The GHG emission reductions or removals from the mitigation activity shall not be double counted, i.e., they shall only be counted once towards achieving mitigation targets or goals”, Core Carbon Principles, The Integrity Council

2. Energy certificates can be used to claim lower scope 2 emissions, and are therefore a form of carbon credit or offset. To be high integrity offsets, they should align to The Integrity Council’s Core Carbon Principles.

by Chris Hargreaves | Nov 14, 2023 | Carbon Sustainability, Energy, News

These days, embracing sustainability is not only a vital choice, it’s a game-changing strategy! At Total Utilities, we help businesses like yours optimise, reduce costs, and contribute to a greener world every day.

We understand the hurdles businesses face, and are well-equipped to guide you towards a future where efficiency meets sustainability. Our customer-centric approach ensures that your business not only embraces eco-friendly business practices, but also reaps the tangible rewards.

Advantages tailored to you

Every business is unique and that’s why our services are carefully tailored to meet your specific needs. By leveraging data-driven insights, we empower you to optimise your operations, reduce costs, and make meaningful contributions to environmental conservation.

Let’s look at four major ways Total Utilities can help make sustainability a compelling and advantageous choice for your business:

COST EFFICIENCY & SAVINGS

We pinpoint areas for improvement, negotiate highly competitive contracts with our procurement service, and implement strategies that lead to substantial cost reductions. Your bottom line matters, and we’re dedicated to enhancing it. Our services include:

– Conducting comprehensive utility audits: Evaluating and optimising your current utility expenses.

– Identifying energy optimisation measures: Eliminating unnecessary energy consumption.

– Negotiating competitive strategic contracts: Securing cost-effective utility contracts tailored to your business needs.

SUSTAINABLE PRACTICES WITH REAL IMPACT

Contributing to a greener world is a shared responsibility. Choosing Total Utilities means actively choosing and engaging in sustainable business practices. Our tailored services include quantifying your carbon footprint and recommending carbon measures to decarbonise your business. With us you can:

– Track and reduce your carbon footprint: Utilising our advanced tools to measure, analyse and reduce carbon emissions.

– Integrate energy-efficient practices: Implementing technologies and strategies for reduced energy consumption.

– Establish a waste reduction programme: Comprehensive and cost effective waste reduction and recycling initiatives.

INTEGRATE SERVICES WITH THE FLEXIBILITY TO START SMALL

We understand the complexities of modern business and that’s why you can bundle up our services any which way you like, with tailored, hassle-free, and seamless integration! Begin with one service and add on others as your sustainability journey progresses. For example:

– Start with utility procurement

– Add on carbon measurement and reduction with our Carbon Insights service

– Add on a waste audit.

EXPERT GUIDANCE & CONTINUOUS SUPPORT WITH CLEAR ACTIONS

Total Utilities not only provides compelling services, but our seasoned experts are dedicated to helping you make informed decisions with straightforward, practical advice.

– Engage in expert training sessions: Helping you interpret utility data and explore cost and carbon savings.

– Benefit from dedicated support: Tailored suggestions for continuous improvement based on your unique business needs.

– Manage regulatory risks: Expert guidance to ensure your business’s sustainability responsibilities are always met.

– Support with Greenhouse Gas Emissions Programmes: Helping you disclose your emissions and drive for continuous improvement.

Your success is at the heart of all that we do. We are not just service providers, but we are your partner in sustainable growth.

Let’s unlock the potential of data-driven sustainability to make your business more efficient, environmentally responsible and economically robust.

Contact Total Utilities today and discover how our services can empower your business towards an extraordinary future of sustainable success.

by Chris Hargreaves | Nov 14, 2023 | Carbon Sustainability, Energy, Energy Attribute Certificates (EAC's), News

Contributed by Paul Coster, Founder of EVA Marketplace

As businesses navigate the need to slash fossil fuel usage, the burning question is: can backing renewables be both a pragmatic commercial decision and contribute to climate action?

Some businesses may be surprised that while Aotearoa’s electricity is ~85% renewable, our energy consumption is only ~30% renewable. This means around 70% of New Zealand’s energy consumption is met by burning gas, oil and coal, mainly for transport, heat and electricity production.

So, how do businesses burn less fossil fuel, and therefore meaningfully contribute to climate action? There are three main options:

-

- Eliminating or reducing fossil fuel use (e.g. reduce air travel, encourage active and public transport)

- Increasing energy efficiency (e.g. improve building insulation)

- Supporting renewable energy

In this article, I’m going to focus on ‘supporting renewable energy’, which is a more nuanced topic than you might think. Currently, there are two climate-friendly options for New Zealand businesses to support renewable energy:

- Demand response: consume more electricity when renewables are plentiful, and less when gas and coal-fired generation is running.

- Additional renewables: procure electricity in a way that helps to add more renewables to the electricity system.

At this juncture, I need to briefly discuss three other commonly discussed renewable energy options:

- Green hydrogen (hydrogen made from renewable electricity)

- Biogas and biomethane

- Woody biomass

Globally, green hydrogen is in its early stages and, in New Zealand, biogas and biomethane are in their infancy. Currently, woody biomass is primarily used in the wood, pulp, and paper sectors, where harvest residuals are readily available (*1).

Experts and scientists are cautious about the scope of these fuels in the clean energy transition due to issues such as: green hydrogen’s inefficiency compared to direct electrification of heat and most land transport (*2), the challenging economics of large-scale biogas/biomethane production in New Zealand (*2), and elevated CO2 emissions over decades created by burning woody biomass produced from whole trees (*3 & *4). In my view, woody biomass production should be limited to harvest residuals, and priority given to its use as energy storage to address electricity shortages.

Ok, returning to demand response and additional renewables:

Demand response

Demand response (also called ‘load shifting’) is the shifting of electricity consumption into periods of time when renewables are plentiful (and out of periods of time when it’s scarce), and was discussed last month by Andy Cooper from The Energy Collective.

Andy explained how businesses can use demand response to save money, reduce scope 2 carbon emissions, and help defer costly investment in the electricity network. He also discussed current limitations of Renewable Energy Certificates (RECs), also called Energy Attribute Certificates (EACs).

Additional renewables

It’s necessary to support additional renewables such as wind and solar, otherwise new electricity demand (e.g. EVs, heat pumps) will need to be met by gas or coal-fired generation.

According to the Climate Change Commission, Aotearoa needs approximately an additional 1,000 GWh of renewable electricity every year between now and 2030 to meet our climate targets. That’s around 2.5% of New Zealand’s annual demand (~40,000 GWh), roughly equivalent to 300 MW of wind or 550 MW of solar, every year.

So, how can businesses help add renewables to New Zealand’s energy system? Impactful and readily available solutions for businesses are:

- On-site renewable generation (e.g. rooftop solar)

- Corporate Power Purchase Agreement (PPA) (*5) with a renewable generation project (i.e. a business buys electricity directly from a generation project)

- Indirect PPA with a renewable generation project (i.e. a PPA entered into by an electricity retailer on behalf of a business)

- Electricity supply agreement (*6) linked to a renewable generation project

Businesses can combine these solutions, such as having on-site generation, a corporate PPA and an electricity supply agreement. Combining a PPA with a supply agreement is called PPA ‘sleeving’. For all solutions, businesses retain a relationship with an electricity retailer.

In Part 2, I’ll look at each solution in detail, discuss their pros and cons, and explain why solutions 1 and 2 tend to be the most impactful. I’ll also discuss the important role played by RECs, or EACs, explaining why these certificates should be used in most cases.

These posts are my current thinking, which I hope opens up more discussion about the impact businesses can have on Aotearoa’s clean energy transition.

—

About Paul Coster

Paul is the Founder of EVA Marketplace, Aotearoa’s marketplace for renewable PPAs. EVA assists businesses by matching them to renewables projects, facilitating PPA negotiations, supporting green products (including RECs/EACs) and enabling corporate PPA sleeving. EVA also publishes a quarterly report on the renewables market.

Total Utilities works with EVA to offer customers the option of a corporate PPA sleeved into their electricity supply agreement, helping to control electricity costs and ethically reduce carbon emissions, while retaining the convenience of an FPVV supply arrangement.

* References

- Biomass energy in New Zealand, EECA

- 2023 Draft advice to inform the strategic direction of the Government’s second emissions reduction plan, Climate Change Commission

- Why burning trees for energy harms the climate, World Resources

- 500+ scientists tell EU to end tree burning for energy, WWF

- PPAs tend to be longer term contracts (5 – 15 years) where a buyer commits to buying electricity from a specific project, such as a solar farm, usually at a fixed price.

- Electricity supply agreements tend to be shorter-term contracts (1-5 years) where buyers purchase electricity from a retailer for their sites or buildings, typically at a fixed price.

by Chris Hargreaves | May 21, 2023 | Energy, News

Electricity transmission pricing hike delivers nasty jolt

Changes to national grid operator Transpower’s transmission charges took effect in April – and as with most things in life, there are winners and losers.The updated transmission pricing methodology (known as TPM) significantly differs from previous years, and has delivered a mixed bag of rises and cuts for domestic and industrial users.

State owned enterprise, Transpower, has been allowed to recover $830 million by the Commerce Commission for running the network and the increased costs are now being passed on to end users.

Changes to charging methodology

Transpower Head of Grid Pricing Rebecca Osborne said the Electricity Authority has designed the new methodology to more closely reflect the costs and expected benefits of electricity transported across Transpower’s 12,000 kilometres of transmission lines.

There should be no surprises across the electricity industry about the new transmission charges, she said.

“We’ve consulted with customers along the way and provided information as the elements have developed, including updating our indicative prices… and providing indicative rates information in early November.”

“Total transmission revenue, as set by the Commerce Commission, remains the same, but how it is distributed among Transpower customers has changed.”

Encourage renewable generation

The Authority expects the new approach to transmission charges to encourage investment in renewable generation and electrification of industrial processes.

According to Transpower, the main change in the new transmission pricing is a move to a benefit-based approach where customers pay in proportion to the benefit they are expected to receive from some historic and all future transmission investments.

The previous methodology spread the cost of the HVDC (High Voltage Direct Current) link connecting the two main islands across South Island generators and spread the cost of all other interconnection assets across local lines companies and major industrial users.

Some Northland, East & West Coast customers hit hardest

In general, this means cost increases for local lines companies and some of the largest industrial customers in the north of the country because they are further away from where the bulk of generation is located in the South Island.

It also means North Island generators will begin contributing to the cost of the interconnected transmission assets and South Island generators will contribute less.

Consumers in Northland, the east coast of the North Island, and the West Coast have faced the biggest hikes, while Wellington and some South Island areas have seen prices fall.

The final amount that consumers pay for their transmission charges is ultimately decided by local lines companies, these charges typically make up between 8 and 10 percent of power bills.

Big power users such as the Tiwai Point aluminium smelter have seen an almost $10m price cut, while NZ Steel mill at Glenbrook faces an $11m increase.

Earlier in the year the Electricity Authority calculated movements would generally be small.

Those most affected may take issue with this. Indeed, Buller Electricity filed for a judicial review after being told its transmission charges would rise by 427 percent.

by David Spratt | Apr 5, 2023 | Energy, News

As renters and homeowners in the 1970s and 80s we were accustomed to hot water cylinder ‘ripple control’ – the mechanism whereby power companies assured us of a cold shower when we got home from work.

The trade-off was that households were able to operate stoves, lights and televisions without power cuts. Then along came the Clyde Dam and all this went away.

Until now.

If we take all our light vehicles off the road and replace them with EVs, this would increase our electricity demand by 20% (EECA Nov 2022). Add to this new ‘green’ data centres built by Google, Microsoft, AWS and our own IT companies, and this will likely add a further 10% to our current electricity needs. Our already stretched electricity supply infrastructure simply won’t cope.

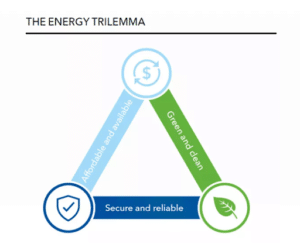

The Energy Trilemma is defined as the need to find balance between energy reliability, affordability, and sustainability and its impact on everyday lives.

Understanding the challenges to balancing these three core elements is vital to keeping the lights on, the economy operating and achieving goals such as Net Zero carbon emissions.

Energy Reliability

The energy system aimed at ensuring reliability in New Zealand is made up of three interconnected parts:

Generation which comes mainly from the dams in South Island Lakes.

Transmission – Transpower’s multibillion dollar electricity supply backbone, built mainly in the 1950s and 1980s on 30,000 properties, with 25,000 transmission towers supporting 11,000 kms of lines and their essential 170 substations.

Distribution – Delivering electricity to homes and businesses via 27 regional Lines Companies, most of whom are locally owned. These companies own the power poles, lines and transformers that bring electricity to our door.

These three elements are highly regulated and involve investments in assets worth billions of dollars.

Our whole energy system is funded by debt that must be paid for by current and future generations.

Who pays and when is the big issue here. Is it today’s user, their children or their children’s children?

This is called intergenerational debt servicing and presents huge challenges when deciding the fairest way to distribute the cost of assets that in some instances might have a useful life of fifty years or more – or in the case of dams much longer than that.

To make things worse, an emerging issue with these investments is the risk of what is known as ‘stranded assets.’ This happens when transformational technologies such as solar and wind based distributed energy systems makes further investment in centralised dams, transmission and distribution uneconomic. When this happens the debt remains but the ability to pay by leveraging (charging for) existing or new assets is reduced or disappears completely.

Affordability and Equity

The New Zealand economy is reliant on agriculture which in turn is reliant on energy. However, economic theory suggests that on a ‘user pays’ basis, a farmer in a remote location should pay more than an apartment dweller in a big city or town. After all it is, at first glance, far cheaper to provide an urban dweller power than it is to run kilometres of copper wire to a small number of farms down a rural highway.

Recent changes to the way costs are allocated for Transpower’s transmission backbone came up with the proposition that the further you are from the source of the power (the lakes) the more you pay because you accrue greater benefit.

This means that a dairy farmer in Northland pays much, much more for connection to the grid than a Southland farmer producing the same products with the same amount of electricity. It conveniently ignores the fact that three quarters of the population of New Zealand is in the North Island and therefore paid for at least this proportion of the massive costs of building our generation and transmission infrastructure in the first place.

Taking this economic puffery to its logical extreme we should be seeing city lines companies like Vector punishing those who are not living in the inner city by charging more for connections to their homes. Thank heavens for the Elected Trustee model that makes this kind of logic totally politically untenable.

While the Trust model provides a level of protection from purist economists, unelected energy officials aren’t as susceptible to the wrath of the voters.

Our government market regulator, the Commerce Commission, doesn’t even have an affordability or equity objective when addressing the electricity market. Instead, it’s ‘Right investments, Right Time at the right cost.’

What about doing ‘right’ by the rural communities generating enough food for 40 million people globally and generating exports in excess of $72 billion annually?

Sustainability

Electricity generated by gas fields, coal and oil fired power stations is expensive, carbon emitting and directly impacts the wholesale market price of electricity.

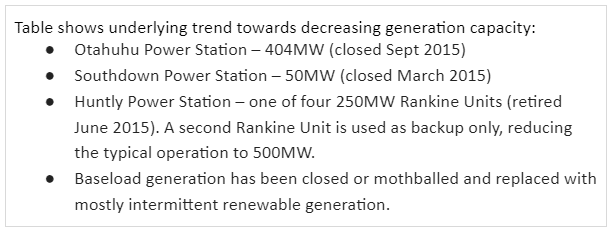

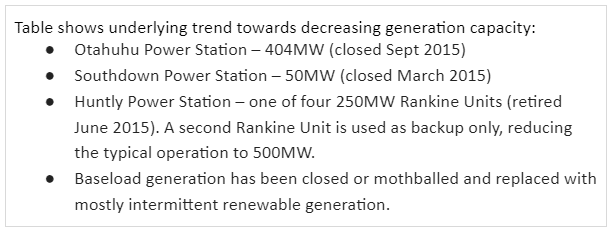

Over the past decade or so we have seen a steady decrease in their contribution to the country’s generation capacity as generators have switched off coal and gas fired capacity. A government ban on further oil and gas exploration and the rapid decline in our existing gas resources in and around Taranaki has placed even more pressure on our electricity supply.

The net result, as demand threatens to exceed supply, is that wholesale and forward prices are at record levels now and well into the future.

One answer to this supply issue might be Lake Onslow – pumped hydro – essentially a $17 billion, ten year project to deliver a giant hydro powered battery designed to help protect against hydro shortages.

Adding 1200 megawatts capacity (roughly an eighth of the country’s current peak capacity) would potentially help bring the volatile wholesale market for electricity back to some semblance of normality.

The Government has just made a decision to complete a $70 million business case on Lake Onslow. Add to that the $30 million they have already spent and it looks like this decision will be a major electricity industry inflexion point.

It’s difficult to see the GenTailers detaching themselves from the status quo and its associated super profits. As such it has been no surprise at all to see them aggressively highlight research from reports that paint the Onslow Project as an expensive and impractical idea.

What I have failed to see is any practical alternative being offered – other than the monopolists’ favourite – punishing vulnerable consumers into changing their behaviour by raising prices at peak time. This is not a great option when young consumers are juggling hungry children, bath times, winter heating bills and brutal mortgage interest rates, and dairy farmers have cattle lined up outside the sheds for milking.

Barring the embedded carbon costs of construction materials like steel and concrete, Onslow offers a sustainable opportunity to enhance the viability of inconsistent generation sources such as solar, wind and tidal generation. By providing a massive hydro based battery to store load as and when it is created, we could see wholesale prices back in the 8-12 cents per kw.

This would see the benefits of lower input costs flowing to farms, businesses and households instead of into the pockets of the gentailers and governments eager to feed off the dividends their super profits are providing.

- Part three of this series will address that most controversial of subjects – Water, Waste and Stormwater. Call it Three Waters if you like. I call it a right mess.

by Chris Hargreaves | Jan 24, 2023 | Energy, News

Shop around early for new energy contracts is our advice to customers seeking to avoid the risk of skyrocketing energy prices this winter.

Our warning comes hot on the heels of Transpower cautioning that the Electricity Authority’s recommended measures to ensure the security of electricity supply for this coming winter are insufficient, and that urgent action is now needed to prepare for winter demand.

The Gas Industry Company is also ringing the alarm bells saying, “To avoid the situation where some customers are coming to market at times of tightness across the energy sector, we advise industrial and commercial gas customers with upcoming contract renewal to ‘go to market’ for supply well in advance of the contract expiring. It is our view that going to market early will reduce the exposure risk associated with low hydro inflows impacting on gas supply in Q2, 2023.”

Decreasing generation, rising prices

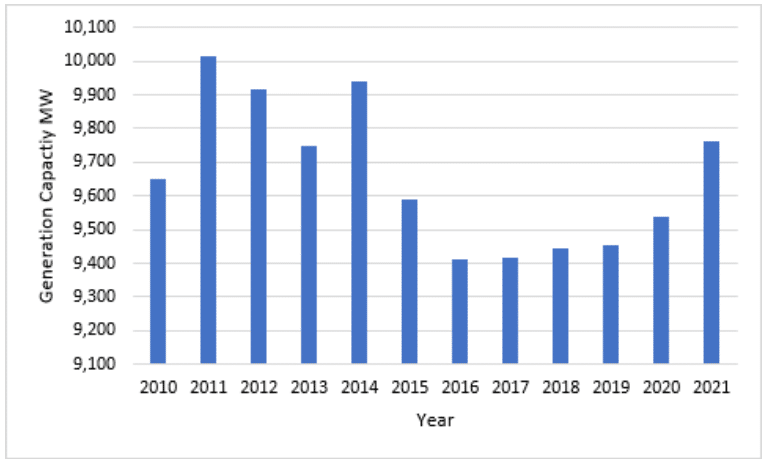

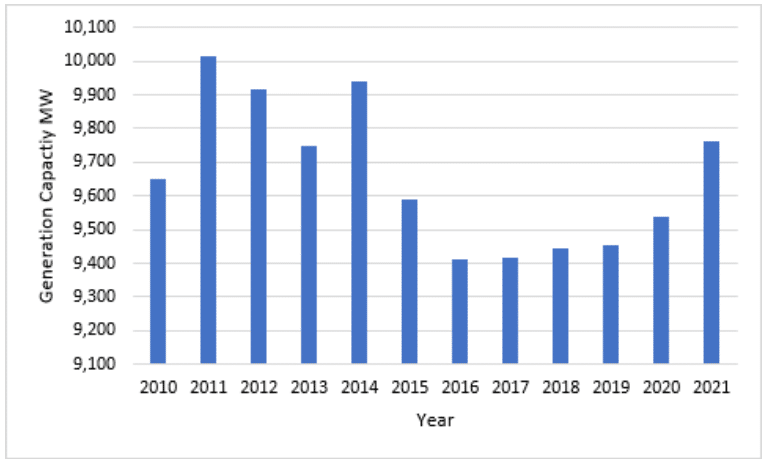

So how and why has this situation arisen? Well, it’s been a long time in the making with NZ’s operational generation capacity reducing since 2010, as thermal base load generators have closed and not been replaced.

New generation that has come on stream since 2010 is mostly intermittent wind generation that is reliant upon the caprice of mother nature. Consider the fact that on an annual basis, NZ wind farms generate at an average of 40% capacity – meaning replacing baseload thermal capacity with like for like wind capacity results in an average 60% shortfall.

The early bird catches the worm…

With all indications pointing towards winter shortage and increasing price volatility, we encourage our clients to review the market well in advance of energy contracts expiring. This allows time to shop around and find the very best deals for your business while you still have some room to manoeuvre.

Leaving it to the last minute will likely leave your business exposed to the vagaries of the winter market and the possibility of surging prices. You could be forced to accept increasingly unfavourable energy contracts that end up costing your business dearly.

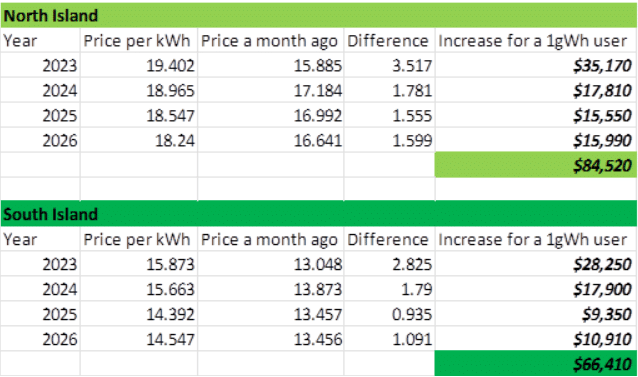

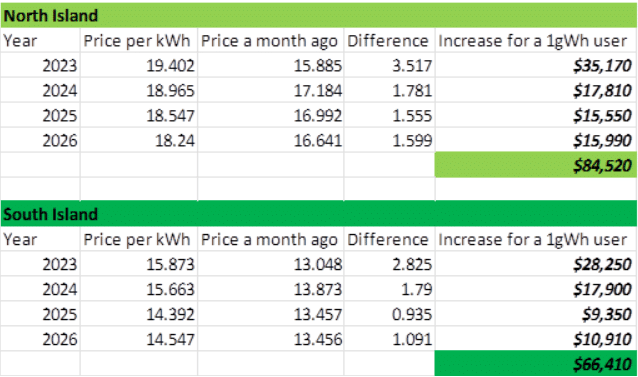

The below tables show how prices have surged over just the last month:

Light at the end of the tunnel?

While the current picture of the energy market seems fairly bleak, there is perhaps some room for optimism with signs pointing to new generation in the pipeline – albeit slowly.

News from Transpower is that NZ could bring on more than 7230 megawatts of new grid-connected generation capacity if the top 51 projects in its new Connections Management Framework are commissioned. Six projects totalling 595MW are currently in delivery phase with 22 projects under investigation.

A Transpower spokesperson says that the new framework, which went live in November, was developed in response to the sharp increase in grid connection enquiries during the 2021/22 financial year. They say enquiries to connect new generation projects to the grid have increased from around five per year, to 124 in FY22.

The new framework has been encouragingly described by Helios Managing Director Jeff Schlichting as ‘robust’ and he believes it should work well to ensure the timely development of renewable energy projects needed to help the country decarbonise and meet its climate change commitments.

Here’s hoping that Jeff’s got it right and that things are finally starting to move in the right direction. In the meantime it pays to prepare early and hunker down for the winter of energy discontent.

Sign up below for Total Utilities Market Commentary to receive all the latest market news and insights.